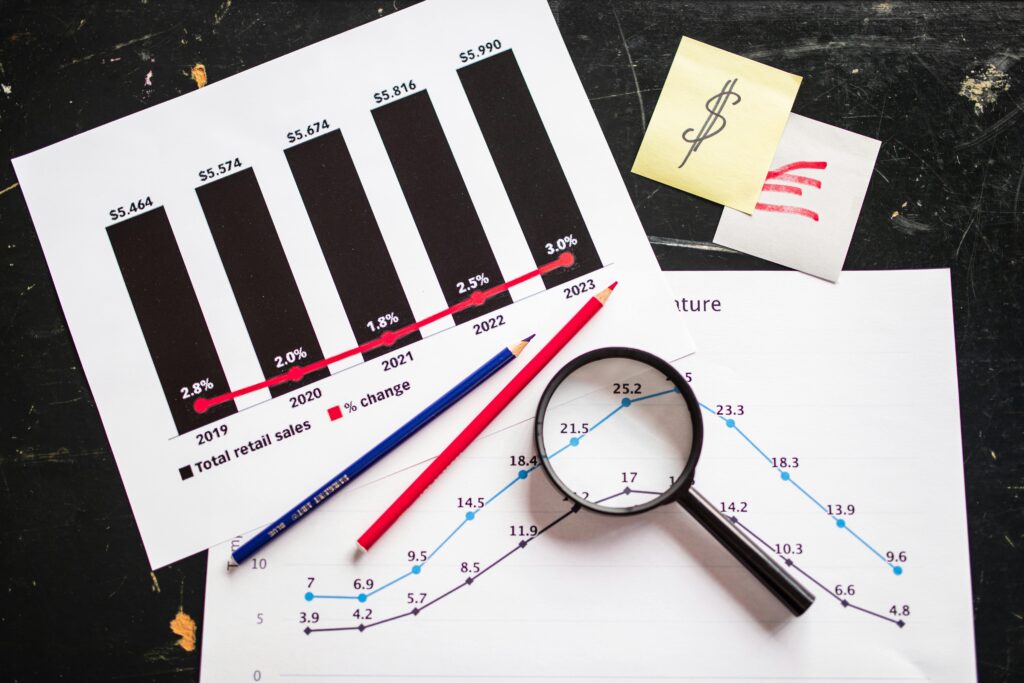

The UK economy has stalled, with official figures revealing zero growth between July and September. This news comes as a blow to the government, which has made boosting economic growth a top priority. The revised figures follow a string of disappointing economic data, including a surge in inflation and an unexpected contraction in the economy in October.

The news has sent shockwaves through the business community. The Confederation of British Industry (CBI), a leading business group, warned that the economy is “headed for the worst of all worlds.” Their recent survey found that private sector businesses across all industries anticipate a “steep decline in activity” in the coming months.

“Expectations are now at their weakest in over two years,” said Alpesh Paleja, the CBI’s interim deputy chief economist.

The retail sector is also feeling the pinch. A survey by the British Retail Consortium, which represents major retailers like Marks and Spencer and Tesco, suggests a “January spending squeeze” is on the horizon for consumers. Consumer confidence has plummeted, and retailers are facing tough choices – raise prices to maintain profit margins or cut costs, which could lead to job losses and store closures.

Mick Dore, general manager of the Alexander pub in Wimbledon, echoed these concerns. “All of December we’ve been crazy busy with loads and loads of work parties,” he told BBC Breakfast. “But there are cost implications going forward with the rise in national insurance contributions for our staff. We have to have a good Christmas to insulate ourselves against that.”

The government is facing mounting pressure to address these economic challenges. Chancellor Rachel Reeves acknowledged the “huge” challenge of fixing the economy after “15 years of neglect.” However, the opposition, led by the Conservative Party, has criticized the Labour government’s handling of the economy, pointing to the stagnant growth as evidence that their policies are failing.

Economists are divided on the outlook. Some, like Paul Dales, chief economist at Capital Economics, believe that the slowdown is temporary and that a boost from lower interest rates is on the horizon. However, others, like Simon French, chief economist at Panmure Liberum, are more concerned. He believes these figures could be a sign of a more serious economic downturn, potentially even a recession.

The Bank of England also expressed concern, holding interest rates steady on Thursday and acknowledging that the UK economy had performed worse than expected, with no growth at all between October and December.

This period of economic stagnation presents a significant challenge for the UK government. They must navigate a difficult path, balancing the need to address rising inflation and support businesses while also fostering economic growth and ensuring a prosperous future for the country.

Feature Photo by RDNE Stock project: https://www.pexels.com/photo/black-and-white-round-magnifying-glass-on-white-printer-paper-7947758/

Central Photo by Nataliya Vaitkevich: https://www.pexels.com/photo/person-in-green-and-white-polka-dot-long-sleeve-shirt-writing-on-white-paper-7172830/